UK banking firms most prepared for the ‘new normal’ in the workplace

With the government now a week into its 50-page roadmap out of lockdown, a new report suggests that UK banking firms were the most prepared for the rise of remote and flexible working pre-lockdown compared to other industries.

The research, which analysed thousands of job descriptions, employee reviews and forums for the UK’s biggest businesses, suggests that the work done by banking firms to offer flexible working pre-pandemic leave them with ‘less’ work to do in order to thrive as lockdown restrictions are lifted and we acclimatise to the ‘new normal’.

Based on the ten biggest employers for 20 of the UK’s largest cities, the research identified the industries and locations that were leading the way in terms of flexible and remote working for staff and which companies would need to make the most changes when we fully return to work.

Banking firms were the most generous for offering staff choice when it came to working hours in addition to being ranked second for remote working opportunities. This resulted in banking firms topping the overall employee flexibility at work rankings ahead of the tech and aviation industries.

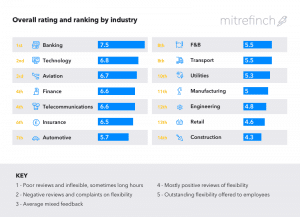

To calculate the rankings, content and thematic analysis was used to analyse thousands of employee reviews to provide an overall ranking score for flexible working, remote working and an overall score. The banking sector scored 7.5 out of 10 overall putting it at the top of the rankings.

The full rankings were as follows:

Employers in the construction, retail and engineering appeared at the bottom of the overall rankings, where staff were given the least opportunities to dictate their working hours and location.

Matthew Jenkins, CEO at global workforce management solutions provider Mitrefinch, which conducted the research, said:

“It’s no secret that the past couple of months have been some of the most challenging for UK businesses in recent years, and with some elements of restrictions likely due to remain in place upon lifting the full lockdown, there looks to be significant challenges in the months and years to come.

“The challenges obviously vary depending on the line of work of each operating business, but it’s interesting to see the regional variance across the UK, which indicates some towns and cities have some work to do to address this balance in the coming months.

“Businesses are going to have to become more agile and flexible than ever before in order to achieve growth during this pivotal period, as well as ensuring staff remain healthy, both physically and mentally. However as we have seen over the past few weeks, many have been able to use technology to be as productive as they were pre-coronavirus.

“The rise of remote and flexible working was already prominent prior to this pandemic but Covid-19 has forced staff to really consider if they really need to be in an office to get their job done. And for businesses, to consider the potential cost savings of moving to smaller physical offices and a movement towards more virtual ways of working.”

Jenefer Morgan, head of people, at independent asset manager BOOST&Co, added:“Firstly, businesses operating in the banking and financial services industry are not creating a physical product; there are no production lines, or requirements for large workshops and storage facilities, and for firms like ours – that are not customer-facing – there is little requirement for a physical presence either.

“Financial service firms are however, heavily invested in technology. The requirement for secure servers and platforms that host large amounts of sensitive data, influences the role of technology across the rest of the organisation; basic remote-working equipment such as laptops and mobile phones are commonplace, as are digital tools to promote collaboration.”