Transforming banking training programs with LXP

The financial sector is going through a period of transformation. On the one hand, the emergence and development of technologies such as artificial intelligence and machine learning require the financial sector to actively implement them in order to keep up with technological advances and competitors. In fact, the financial industry has one of the highest rates of AI adoption compared to other industries. Both generative AI and ML are being implemented.

In 2023, about $35 billion was invested in AI.

At the same time, financial institutions are under constant pressure to adapt and innovate due to strict regulations and increased customer focus.

As a result, the industry’s workforce lacks the relevant knowledge and skills to navigate the digital age with ease. The solution to this problem is a Learning Experience Platform (LXP). This tool addresses the skills gap in the financial sector by equipping professionals in the field with the necessary competencies.

In this article, we will look at how an LXP can not only increase the effectiveness of training, but also transform banking training programmes.

What is an LXP?

Simply put, it is a digital platform for delivering online learning. It includes a range of modern and proven options for delivering a customised learning experience. What I personally like about LXP is that it can be customised in any way you like. And it’s not just about industry specifics; LXP can be tailored to the specific needs of your bank. So when it comes to LXP learning solutions for the financial sector, it’s definitely not a one-size-fits-all solution. It is usually a feature-rich LXP platform that contains training modules and knowledge tailored to the specifics of the industry and current market changes, regulations, etc. As a result, when banks adopt LXP, they get optimised training solutions in every area, whether it’s improving customer service, educating partners, driving sales, mastering new ways of working and more. Properly designed and configured, top learning experience platforms can quickly and effectively address all of the organisation’s current training needs.

Why do banks need an LXP?

It would be a mistake to think that LXP is a market-driven whim. The need for a quality LXP is critical for banks because the financial sector, like the healthcare industry, requires highly skilled professionals. It is the knowledge and level of customer service that determines the future of a financial institution. Let’s not forget that this industry is characterised by complexity, strict regulation and ever-changing customer demands. The ability to meet these challenges and provide exceptional customer service depends largely on the skills of the bank’s people. This is one of the reasons why LXP is essential in the banking industry.

Let’s look at the others:

- Compliance constraints that need to be addressed to stay within the law and avoid fines and reputational damage.

- The emergence of new technologies and ever-changing industry needs, and the need to keep up and respond to market challenges to stay in business.

- The wide geographical distribution of teams and the existence of common business processes and knowledge that must be adopted by all employees.

The financial sector is constantly changing, whether through new legislation, operational changes or new technologies. As a result, continuous training of employees is expected to be essential.

How LXP is transforming bank training programs

Source: https://www.globalgrowthinsights.com/market-reports/learning-experience-platform-lxp-market-102110

We’ve talked a lot about how useful and necessary LXPs are for banks and financial institutions in general. But just how useful are they? What makes them essential? Let’s take a look at the specific benefits of the LXP platform.

Total compliance

If you’re in the financial industry, you know that constant change is the norm, and responding to that change while remaining compliant is a real challenge and a must. That’s why LXPs are in such demand here, especially on-premises solutions, which statistics show are often preferred by large organisations where data security, control and strict privacy regulations are paramount. They provide you with the knowledge you need for every situation, from policy changes to mergers. With this system, you can implement the latest training programs to ensure compliance.

Finance-specific knowledge and personalised learning

Source: https://financialservicesskills.org/wp-content/uploads/2024/04/FSSC-Future-Skills-Report-2024.pdf

Forget one-size-fits-all and overly generalised knowledge. Having an LXP means having access to the innovative solutions you need to succeed, because an LXP offers options that meet your specific needs. This could be sales training or the provision of training materials for all employees, as well as certification for selected experts or advanced training.

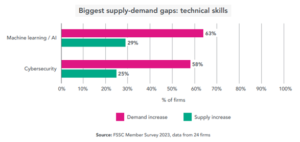

Closing knowledge and skills gaps

Would you agree that every industry needs to identify and close knowledge and skills gaps? However, the financial industry is constantly evolving and a bank needs to ensure that its employees have the right knowledge for the job. The need to address skills gaps is particularly acute as new roles and skills emerge.

A learning experience platform can track learner progress, identify gaps in specific skills and provide appropriate training materials or customise the course based on the learner’s skill level.

Getting everyone on the same page

When you introduce new products or services into your organisation, your employees and partners need to be aware of the changes. The same goes for changes in workflow or business processes. LXP ensures seamless communication between all stakeholders, fostering collaboration and engagement.

And last but not least.

Reduced training costs

One of the biggest benefits of implementing LXP is that it provides online training for everyone at the same time. All critical information is automatically updated and can be accessed by any employee at any time from their computer or smartphone. With LXP, you don’t need additional space, logistics, equipment and the costs associated with maintaining it. At the same time, the training process is continuous and up to date.

Features your LXP should have

Let’s look at what LXP should have to do all the things we talked about above.

Tracking compliance

Proper compliance tracking is critical to protecting both the bank and its employees. This means that LXP must be equipped with powerful tracking features that monitor the progress of employees in completing the mandatory training that is critical to meeting regulatory standards.

By having a record of where and how everyone has been trained, the bank can prove compliance in the event of an audit or compliance review. Let’s face it, this not only saves you from potential fines or penalties, but also fosters a culture of accountability and responsibility within the organisation.

Social learning capabilities

It’s about collaboration and coordinated interaction between employees, because you may have multiple locations and everyone needs to be on the same page. Social learning can be facilitated through chats and group projects where people can share their opinions and knowledge and work together on common problems. Frankly, this option is more like team building than training. Not only does each employee feel they are not alone in this learning journey, but a sense of community is created.

Analysis and reporting

With these tools, employee learning progress (or decline) will not go unnoticed by management. It is the reporting and detailed analytics that show how effective the training has been. At any time, you can access data such as course completion, employee engagement, learning gaps or material that employees are struggling with. All to improve information absorption and manage learning outcomes. There’s a difference between when your employees have just completed a course and when they have mastered key skills and improved your business performance.

Content management tools

Typically, a comprehensive learning platform brings together a variety of content in different formats in one place and enables content creation. LXP for Banking is no exception, as access to a variety of content is key to meeting the personalised learning needs of the financial sector.

In addition to lectures, videos, articles, quizzes, images or AI-driven content options, platform users should be able to create and share content themselves. All of this contributes to increased student engagement and more meaningful learning.

Trainer-led training

One of the must-have features of a modern LXP is the ability to conduct instructor-led training. This feature allows you to deliver distance learning to a large number of trainees at the same time when there is urgent information to be communicated to staff, changes in legislation, or other critical information. The instructor-led option allows you to bring everyone who needs to be informed of these changes under one roof.

Integration with other software

You may not be surprised to hear us say that one of the most important features of LXP for a bank should be the platform’s ability to integrate with other software.

This is the only way to ensure the smooth running of the organisation. Make sure that your LXP can connect to your recruiting and onboarding system, accounting system, chats, marketing campaigns, etc.

Such connectivity allows you to create an intelligent enterprise environment that leads to seamless data sharing and provides insight into each employee’s learning and career development path.

Conclusion

Meeting regulatory requirements and providing employees with up-to-date industry knowledge are critical for a financial institution. An effective solution to keep up with market demands is to integrate a learning experience platform into the bank’s IT ecosystem. This software solution is one of the factors that will help your bank grow within the regulatory and market requirements. We hope this article has helped you to understand the importance of implementing a modern LXP if you are planning for long-term development in the industry. Now it’s time to create an LXP that meets your needs and reap the benefits of this forward-thinking step.