Prices up again but oversupply risks London correction

Prices remain robust but the current spate of new listings suggests that the road to full recovery may soon be marred by oversupply, especially in London, according to the Home.co.uk Asking Price Index for September.

Estate agents had another phenomenally busy month in August, taking on even greater amounts of new instructions, especially in the capital region, East and South East of England. Fortunately, mortgage approvals have also bounced back to more normal levels and this will help digest the glut of new stock.

Of course, the market has been playing catch-up in the wake of the nationwide lockdown and large amounts of new instructions should be expected. While London’s stock levels have been inflated by 37% since April, it should also be borne in mind that the sum total of new listings from March to August inclusive is around 10% less than the same period in 2019. However, greater reassurance for the capital’s property market would be achieved by the attenuation of supply.

By contrast, English regions to the north as well as Scotland and Wales show much more moderate increases in supply, thereby ensuring that demand will not be overwhelmed. In fact, the North East shows no increase at all compared to a year ago, and the number of new instructions in Scotland in August was only 1% greater than in August 2019. Moreover, it is these regions where price growth is most vibrant, especially Yorkshire with annualised gains of 8.8%, and this is pushing up the national average home price significantly.

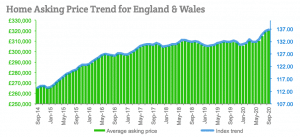

The annualised mix-adjusted average price growth across England and Wales is currently +3.8%; an extraordinary improvement on August 2019 given the circumstances, when the annualised rate of increase of home prices was -0.1%.