Lloyds Bank January Business Barometer

Overall business confidence fell slightly by three percentage points to -7% in the New Year according to the Lloyds Bank Business Barometer (chart 1), revealing concerns about trading prospects and the wider UK economy. The survey captures responses between 4 and 18 January 2021, during which the UK’s tiering system was replaced by a national lockdown. While confidence remains the second highest since May 2020, it suggests that worries about the new variant has dented previous optimism regarding vaccine rollout.

This month’s dip in confidence was driven by a two percentage point fall in trading prospects to -5% and a four point fall in optimism regarding the wider economy to -9%. In parallel, firms’ view of their employment prospects for the next year (chart 2) fell by to two percentage points to -12%, with 21% expecting to increase staff and 33% (up one point) anticipating a smaller workforce. Overall business confidence is calculated by averaging the views of 1,200 companies on their business prospects and optimism about the UK economy.

With many UK firms adapting to new EU trading arrangements, 6% reported experiencing serious disruptions leading to significant supply chain delays or higher costs to their business. In addition, 16% of firms indicated slight, but manageable, delays while 18% felt no impact, but anticipate disruption in the future.

Responding specifically to the current Covid-19 restrictions, businesses stated that these were having a negative impact on sales. More than half (52%) reported lower sales as a direct result of lockdown measures and 10%, were unable to operate or were temporarily closed. However, 38% of businesses said that their turnover saw little impact or a slight increase.

Responding to the Covid-19 vaccination programme, 54% said that the rollout has improved confidence in their trading prospects. Only 16%, however, expect their sales in 2021 or output to return to or surpass levels prior to the pandemic, while 38% see improving sales but expect sales to fall short of pre-Covid-19 levels for this year. However, nearly a quarter (23%) said that their business will continue to struggle despite the vaccine.

Hann-Ju Ho, senior economist, Lloyds Bank Commercial Banking, said: “It has been a challenging start to the New Year for UK businesses adapting to a third national lockdown alongside the new EU trade arrangement taking effect. Nevertheless, while confidence remains below average, it is encouraging that business sentiment is still the second highest since the low of May 2020. Overall, the vaccine rollout programme has lifted confidence and that will hopefully buoy business optimism in the coming months.”

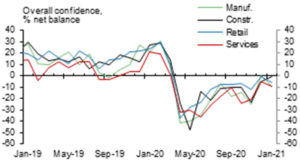

Chart 1: Business confidence only partially reverses last month’s rise Chart 1: Business confidence only partially reverses last month’s rise |  Chart 2: Employment prospects remain negative, but less than last spring Chart 2: Employment prospects remain negative, but less than last spring | |

Chart 3: Confidence significantly above national average in London |  Chart 4: Sector confidence slightly lower in manufacturing, retail and services | |

| Source: Lloyds Bank Business Barometer (January 2021), BVA BDRC |

Regional confidence remains above pre-vaccine levels

Apart from Northern Ireland, business confidence remained higher compared with November (pre-vaccine) levels in all parts of the UK. Compared with last month, confidence fell in five of the nine English regions, with South West (down 13 points to -8%) and East of England (down 11 points to -12%) reporting the largest declines (chart 3). Scotland saw the largest decline in the UK, down 23 points to -32%. London’s confidence was significantly above the national average, up five percentage points to 3%.

Similarly, in the industry sectors confidence remained above pre-vaccine levels (chart 4). While some sectors reported declines, manufacturing slipped by nine points to ‑9%, services fell by four points to -9% and retail by five points to 6%. Confidence levels in the construction sector improved for a second month, rising four points to -1%.

Paul Gordon, managing director for SME and mid corporates, Lloyds Bank Commercial Banking, said: “It has not been an easy start to 2021, but nonetheless businesses continue to persevere and remain resilient in the face of uncertainty and change – the construction sector’s confidence improving for a second month and more broadly, industry and the majority of the regional confidence sitting above pre-vaccine levels. While the road ahead will be challenging, we hope the news of the vaccine rollout progress will positively impact regional and sector confidence in the coming months.”