Insolvency predictions vastly exaggerated, but swift action needed says RSM

Leading audit, tax and consulting firm RSM says that whilst a spike in corporate insolvencies as great or greater than the levels last seen in 2008 is almost inevitable, the current numbers being mooted represent a major exaggeration.

RSM believes there will be an initial flurry of insolvencies, as was seen in 2008, for those businesses who were struggling before the current health crisis emerged, or who had limited resources to fall back on. However, for many others the opportunity to mothball, defer payments and seek government support will at the very least delay any decision to permanently shut, and allow the directors to consider every option available to them over an extended period.

RSM’s prediction comes off the back of recently announced and far-reaching measures by the chancellor of the exchequer including the Business Interruption Loan Support (CBILS) and a Covid Corporate Financing Facility. These measures are welcome, but will not in their own right achieve the Prime Ministers stated ambition of no company facing insolvency as a result of the coronavirus, nor will a large segment of UK businesses even qualify for this support.

Gareth Harris, partner, RSM Restructuring Advisory, comments: ‘Whilst these unprecedented government measures are laudable, the reality still remains that in the short term they will not prevent the insolvency of some companies as they do not directly inject cash quickly enough. And, in the longer term, they may only act as an avoidance or delaying measure, unless other restructuring options are pursued.’

Historic data to predict the future

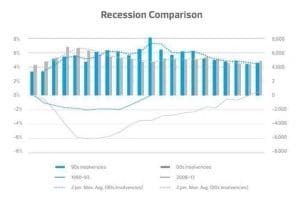

Research by RSM which analyses the two most recent significant recessions (1990-91 and 2008-09), illustrate some notable and consistent trends which will help to understand what the future landscape might look like (see graph below).

Gareth Harris continues: ‘‘Company insolvencies during and after the 90’s recession peaked on the way out of what was a shallower less protracted recession, indicating that companies may have either held on for a period and then overtraded on the way out of the recession and so eventually ran out of cash.

‘The 2008 recession was a much steeper dive and consequently a much earlier and larger spike in insolvencies took place. Back then there was less government support available when compared to the current measures set out by The Treasury. Then you see another much smaller spike later as the economy picked up again – indicating an environment in which businesses overtraded again, or could not hold on any longer as the government support was withdrawn i.e. as HMRC Time to Pay arrangements ran out.’

Graph: horizonal axis represents a 5.5-year period (22 quarters).

Our predictions

Looking at our historic data (above) and assuming the UK heads into recession, then RSM predicts that the downward curve will be much steeper than the 90’s and could be even steeper than in 2008, with a consequent double spike in insolvencies, now, and in say 6-12 months’ time. However, predictions of 800,000 insolvencies seems a major exaggeration given that over the course of the 2008-13 period shown above total corporate insolvencies were less than 114,000.

Gareth Harris continues: ‘The Covid-19 crisis has caused economies across the globe to adopt self-distancing as the de-facto international global public health policy to mitigate the spread of the disease. Unfortunately, that policy requires putting national economies on hold to save lives. Unlike in 2008 when companies continued to trade, albeit with limited means, this time the taps have effectively been turned off, for most. This has likely ushered in the end of the current business cycle.

‘There will therefore almost inevitably be a double spike in insolvencies as a result, despite the government intervention. The major banks face an unenviable balance between lending responsibly (arguably conservatively) and protecting their own futures, versus facing criticism for a lack of support. One thing is certain, the last thing we need now is another banking crisis.

‘For those companies who may be on the cusp of survival, it is vital that they act now and really take swift and often drastic measures wherever possible and effectively go into survival mode. They may still need some form of restructuring process on the way out of the recession, but survive to trade another day.’