Rollee raised €4m to help companies access their customers’ payroll data.

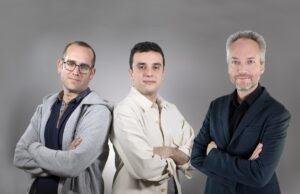

Rollee is joining the European fintech landscape with its employment data platform. Founded by Ali Hamriti, Pierrick Legrand, and Thomas Godart, the company allows individuals to share their employment data, including income & activity, with lenders, insurers and many other businesses. They initially covered gig workers and freelancers and then extended their platform to permanent workers. On the one hand, Rollee allows workers to aggregate their different employment accounts through a secure link and provide a detailed view of their professional situation. On the other hand, the platform enables workers to securely share sensitive documents like payslips, employment contracts, etc.

As a result, businesses using Rollee have a comprehensive overview of their customers’ work situation and can make better decisions.

The startup is already working with clients from various industries including neobanks, accountants, insurance companies, and car fleet managers. Rollee’s solution allows them to modernize employment data collection and make their decision process more inclusive.

The startup is already working with clients from various industries including neobanks, accountants, insurance companies, and car fleet managers. Rollee’s solution allows them to modernize employment data collection and make their decision process more inclusive.

“Employment and payroll data is powerful but not yet readily available to individuals or third parties,” says Olga Shikhantsova, principal with Speedinvest. “Rollee is pioneering connectivity in Europe by making payroll data easily accessible to financial providers, lenders, and neobanks. In just nine months, Rollee has reached 90%+ coverage of gig-economy platforms across two countries and continues to integrate other payroll providers at scale. The result? Improved underwriting capabilities for financial providers, better-tailored products for individuals, and improved financial inclusion.”

Rollee is joining the European fintech landscape with its employment data platform. Founded by Ali Hamriti, Pierrick Legrand, and Thomas Godart, the company allows individuals to share their employment data, including income & activity, with lenders, insurers and many other businesses. They initially covered gig workers and freelancers and then extended their platform to permanent workers. On the one hand, Rollee allows workers to aggregate their different employment accounts through a secure link and provide a detailed view of their professional situation. On the other hand, the platform enables workers to securely share sensitive documents like payslips, employment contracts, etc.

As a result, businesses using Rollee have a comprehensive overview of their customers’ work situation and can make better decisions.

The startup is already working with clients from various industries including neobanks, accountants, insurance companies, and car fleet managers. Rollee’s solution allows them to modernize employment data collection and make their decision process more inclusive.

“Employment and payroll data is powerful but not yet readily available to individuals or third parties,” continues Olga. “Rollee is pioneering connectivity in Europe by making payroll data easily accessible to financial providers, lenders, and neobanks. In just nine months, Rollee has reached 90%+ coverage of gig-economy platforms across two countries and continues to integrate other payroll providers at scale. The result? Improved underwriting capabilities for financial providers, better-tailored products for individuals, and improved financial inclusion.”

A user-friendly platform with its first product for freelancers.

The process of getting customers’ data is straightforward. Rollee’s clients have to send a secure link to their users, and the company proceeds to collect data after the user consents. For instance, PCO drivers can aggregate their different working accounts (FreeNow, Ola..) to update their income and increase their chances of accessing a service like a loan.

“Too many self-employed people are still excluded from financial services because of their working status. As their income comes from different sources, several companies qualify their situation as unstable. Our ambition is to stop those prejudices by bringing clarity to their income and activities, and thus help financial services to make more inclusive decisions”, explains Ali Hamriti, CEO and co-founder of Rollee.

For its €4M fundraising, Rollee has partnered with European VCs such as Speedinvest, Seedcamp, 20VC, and business angels from the fintech industry. Since its inception, Rollee’s had a European vision and plans to consolidate its French and British market position while expanding in Germany and Spain.

The new tech company aims to triple its workforce by the end of the year to achieve this. Rollee is creating a dynamic and multicultural team worldwide as a fully remote company.

The process of getting customers’ data is straightforward. Rollee’s clients have to send a secure link to their users, and the company proceeds to collect data after the user consents. For instance, PCO drivers can aggregate their different working accounts (FreeNow, Ola..) to update their income and increase their chances of accessing a service like a loan.

“Too many self-employed people are still excluded from financial services because of their working status. As their income comes from different sources, several companies qualify their situation as unstable. Our ambition is to stop those prejudices by bringing clarity to their income and activities, and thus help financial services to make more inclusive decisions”, explains Ali Hamriti, CEO and co-founder of Rollee.

For its €4m fundraising, Rollee has partnered with European VCs such as Speedinvest, Seedcamp, 20VC, and business angels from the fintech industry. Since its inception, Rollee’s had a European vision and plans to consolidate its French and British market position while expanding in Germany and Spain.

The new tech company aims to triple its workforce by the end of the year to achieve this. Rollee is creating a dynamic and multicultural team worldwide as a fully remote company.