Business confidence bolstered by rise in economic optimism – Lloyds Bank Business Barometer

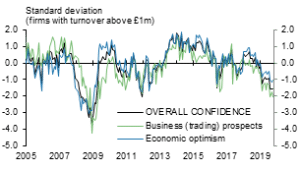

Overall business confidence increased by 4 points to 6% in October, according to the latest findings from the Lloyds Bank Commercial Banking Business Barometer. While still below the long-term average of 24%, it was slightly higher than the previous three months where business confidence averaged 5%. Optimism in the economy also saw an improvement in October, increasing 8 points to a three-month high of -2% having fallen last month to its lowest levels since June 2016.

Firms’ assessment of their trading prospects also rose for a second consecutive month, albeit marginally, by 1 point to 14% (chart 1).

Companies’ concerns about the UK leaving the EU eased this month as the Barometer showed a seven point increase to -18% (see chart 2). 37% of businesses (down from 43%) continue to expect a negative impact from leaving the EU, while 19% (up from 18%) believe leaving the EU will have a positive impact.

In October, the number of firms expecting to increase their employee numbers in the coming year fell by 1 point to 3%, with more than a quarter of businesses (27%) expecting to increase employment, while those anticipating a reduction remains unchanged at 24%. There has been a step down in hiring intentions in recent months, which averaged 12% in the first half of the year. This has fallen to an average of 3% in the last three months.

Chart 1: Business confidence shows more positive outlook

Chart 2: Firms’ concerns of impact of the UK leaving the EU retracted from last month’s decline but remain negative

Source: Lloyds Bank Business Barometer (October 2019), BVA BDRC Source: Lloyds Bank Business Barometer (October 2019), BVA BDRC

Hann-Ju Ho, senior economist, Lloyds Bank Commercial Banking, said:

“Both business confidence and optimism about the wider economy have picked up this month, with economic optimism reaching a three month high as concerns about the impact of the UK leaving the EU eased. However, there was a slight step down in hiring intentions, which could reflect concerns about ongoing economic uncertainty.”

CONFIDENCE ACROSS THE REGIONS AND SECTORS

The most confident regions in October were the West Midlands (16%), the South West (15%) and the East Midlands (13%). (See chart 3). Firms in the Midlands were also among the least negative about the impact of the UK leaving the EU, but this is less the case for the South West, where overall confidence was high despite more elevated concerns about the impact of leaving the EU.

The least confident regions were Scotland ( 18%, despite rising 15 points), the South East (1%) and London (1%).

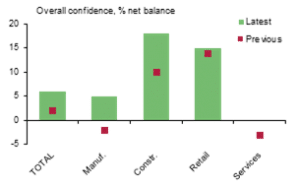

In October, overall business confidence improved in all four sectors, with the largest increases in the construction sector rising 8 points to 18 and the manufacturing sector, which increased 7 points to 5%. Despite confidence in the services sector rising for the first time since June, by 3 points to 0%, overall confidence remained the weakest in this sector, while confidence in the retail sector saw a small increase of 1 point to 15% (see chart 4).

Paul Gordon, managing director for SME and Mid Corporates, Lloyds Bank Commercial Banking, said:

“Business confidence picked up slightly this month, with all regions other than Scotland reporting overall improvements. However, the weakness in London in recent months is notable given that it was the strongest region a year ago. It is reassuring that the overall confidence improved in all four broad sectors, which may also have been supported by the general easing of company concerns about the UK leaving the EU as the prospect of a new agreement drew closer over the course of the month.”

Chart 3: Confidence remains strongest in the Midlands and South West

Chart 4: Confidence increased across all broad industry sectors

Source: Lloyds Bank Business Barometer (October 2019), BVA BDRC Source: Lloyds Bank Business Barometer (October 2019), BVA BDRC